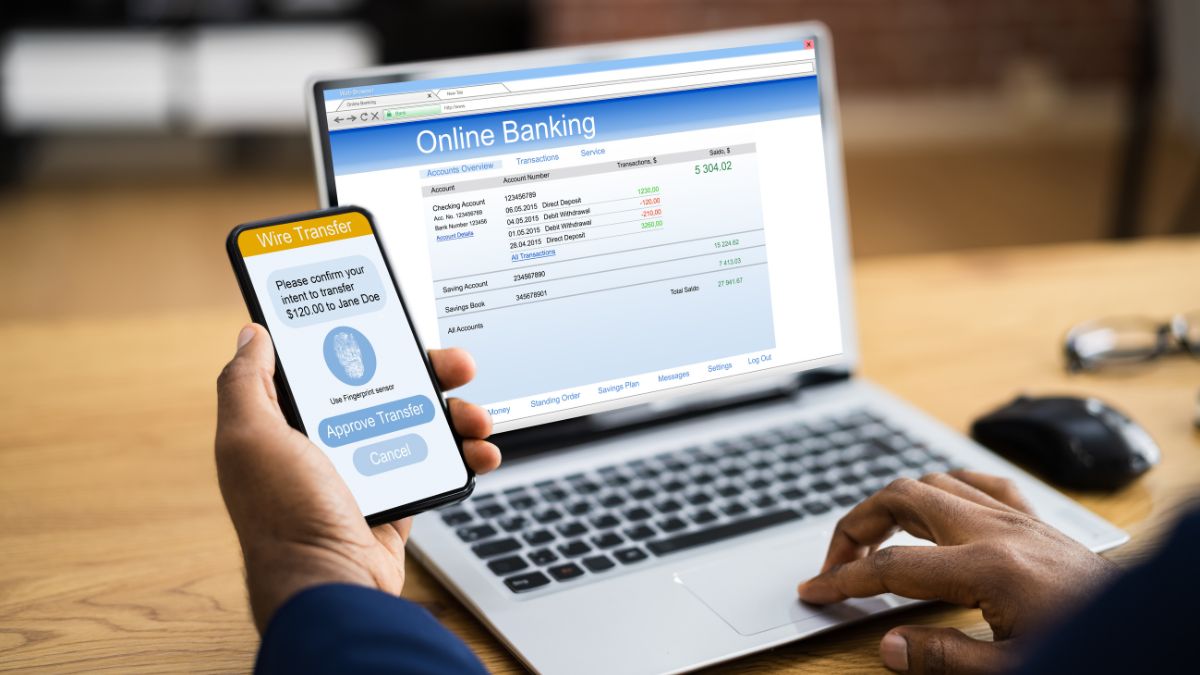

Customers may check balances, transfer cash, pay bills, and apply for loans or credit cards using internet-connected banking websites and mobile applications simply and safely. This accessibility improves client convenience, decreases branch reliance, and promotes broader financial inclusion by making banking services available to underprivileged communities.

Internet access has helped the growth of digital payments and transactions, allowing financial institutions to provide consumers with a wide range of digital payment choices. Customers may use internet-connected devices to execute transactions effortlessly and securely, including online banking transfers, mobile wallet payments, peer-to-peer (P2P) transfers, and contactless payments. This transition to digital payments speeds up transactions, decreases dependency on cash, and encourages financial digitalization and participation in the digital economy.

Internet connectivity helps financial institutions deliver 24-hour customer care via different digital channels such as chatbots, live chat, email, and social media platforms. Customers may obtain assistance and address problems in real time with internet-connected customer care solutions, regardless of time zone or geographic location. This round-the-clock service increases client happiness, shortens wait times, and improves the entire customer experience in the digital banking environment.

Internet connectivity enables financial institutions to use client data and analytics to provide more personalized banking experiences and targeted product offerings. Financial institutions may modify product suggestions, promotions, and marketing messages by analyzing customer behavior, preferences, and transaction history using internet-connected CRM systems and data analytics platforms. This data-driven customization improves client engagement, develops loyalty, and generates cross-selling and upselling opportunities for financial institutions.

Internet access has encouraged financial institutions to invest in stronger security measures and fraud detection systems to secure consumer data and reduce cybersecurity threats in the digital banking ecosystem. Financial institutions can protect consumer accounts and transactions from unwanted access and fraud by utilizing internet-connected encryption protocols, multi-factor authentication (MFA), and biometric authentication technologies. This emphasis on security increases customers' trust, confidence, and loyalty to digital banking services.

Internet access has aided the digitalization of lending and financing operations, allowing financial institutions to provide digital loan applications, approvals, and payouts to their consumers. Customers may use internet-connected loan origination systems and digital lending markets to apply for loans, submit documents, and obtain cash swiftly and easily. This digital lending technique minimizes paperwork, improves approval procedures, and speeds up credit availability for users, hence increasing financial inclusion and capital access in the digital economy.

Internet access has facilitated collaboration and innovation among financial institutions and fintech startups, resulting in the creation of novel digital banking products and services. Financial institutions may collaborate with fintech startups to include innovative goods and services into their digital banking offerings via internet-connected application programming interfaces (APIs) and open banking platforms. This relationship enables financial institutions to use fintech knowledge, agility, and technology to improve the client experience, generate innovation, and stay competitive in the quickly changing digital banking environment.

Internet connectivity has transformed banking in the digital era by providing financial institutions with access to online banking services, digital payments, 24-hour customer assistance, data-driven customization, increased security measures, digital lending, and fintech collaboration. From online banking ease and digital payments to customized experiences and fintech innovation, the internet has changed the way financial institutions operate and interact with clients in today's digital economy. As internet connection evolves, financial institutions must embrace digital innovation, invest in technology, and modify their business models to suit the changing requirements of clients while remaining competitive in the digital banking ecosystem.

Visit our website at https://nextelle.net.au/.

#Internet #Internetconnection #Internetconnectivity #NextelleWireless